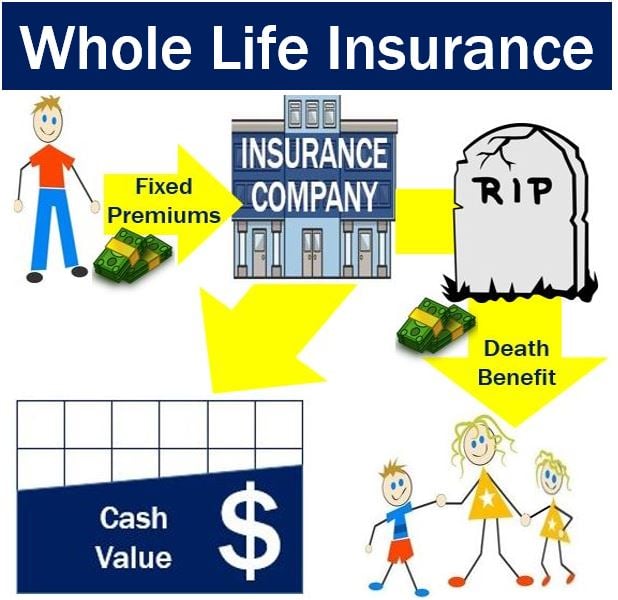

Whole life insurance is a type of permanent life insurance that offers both a death benefit and a cash value component. Unlike term life insurance, which only provides coverage for a specific period of time, whole life insurance covers the policyholder for their entire lifetime as long as premiums are paid.

Toc

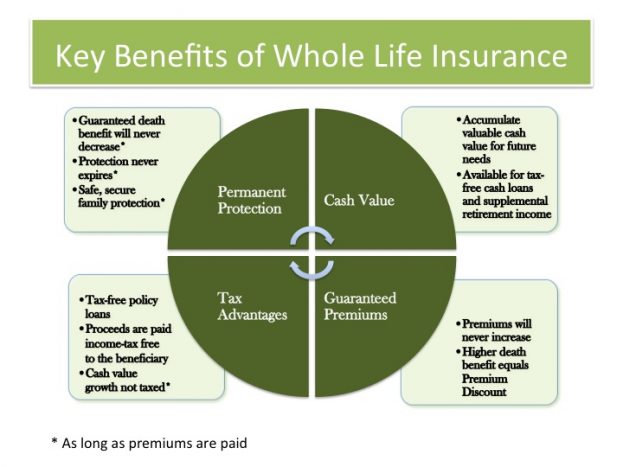

One major advantage of whole life insurance is its ability to accumulate cash value over time. This means that a portion of the premium payments made by the policyholder goes towards building up savings within the policy. As this cash value grows, it can be borrowed against or withdrawn by the policyholder for various purposes such as paying off debts or supplementing retirement income.

Another advantage of whole life insurance is its fixed premiums. Unlike

Introduction to Whole Life Insurance

In today’s uncertain world, financial planning and stability are crucial for young families. One way to ensure your loved ones are protected and your family’s future is secure is through whole life insurance. This article will provide a comprehensive guide to understanding whole life insurance, how quotes work, and why it can be an invaluable addition to your family’s financial plan.

What is Whole Life Insurance?

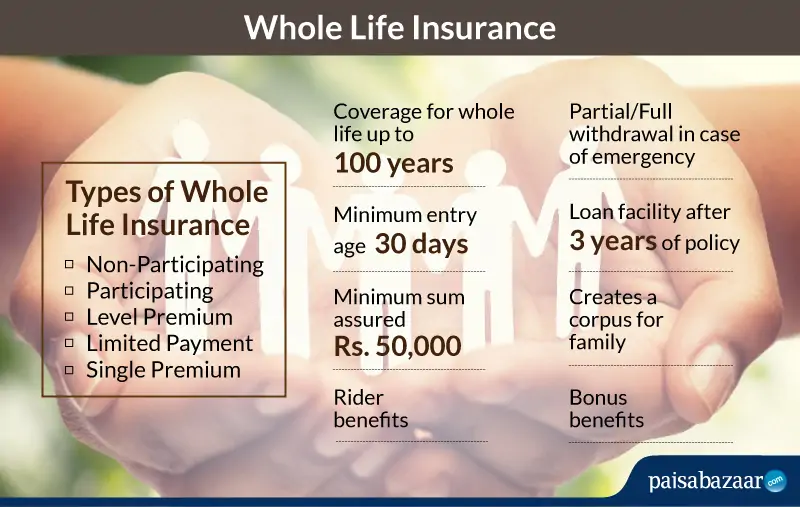

Whole life insurance is designed to provide permanent coverage with level premiums, meaning that the cost of your insurance remains constant throughout your life. This predictability can be especially beneficial for financial planning, allowing policyholders to account for their insurance costs without worrying about rate increases as they age. Additionally, whole life policies often come with a guaranteed death benefit, ensuring that beneficiaries receive a predetermined sum upon the policyholder’s passing. This assurance can bring peace of mind to families, knowing they will be financially supported during difficult times.

Whole life insurance also offers a unique feature called the cash value component, which grows at a guaranteed rate over time. This growth is tax-deferred, allowing the policyholder to accumulate savings that can be accessed in various ways. For example, funds from the cash value can be borrowed against to finance large expenses, or they can be withdrawn for emergencies. However, it’s important to note that taking loans or withdrawals may reduce the death benefit, so careful consideration is required.

In essence, whole life insurance serves not only as a protective measure but also as a strategic financial tool, blending life insurance coverage with a form of savings. As families navigate decisions regarding their future, understanding the nuances of whole life insurance can play a vital role in achieving long-term financial security.

How are whole life insurance quotes determined?

Whole life insurance quotes are personalized estimates of the cost of a policy, based on factors such as age, health, and coverage amount. The younger and healthier you are when applying for a policy, the lower your premiums will be. This is because insurers view younger individuals as less risky to insure, with fewer chances of developing health issues that may result in claims.

In addition to personal factors, the type of whole life policy being quoted also affects the premium amount. Whole life policies can come in various forms, such as traditional or participating policies. Traditional policies offer fixed premiums and death benefits only, while participating policies allow for potential dividends to be paid out to the policyholder. These

Financial Protection

One of the primary benefits of whole life insurance for young families is the financial protection it provides. In the unfortunate event of a policyholder’s passing, whole life insurance ensures that dependents are financially secure, covering essential expenses such as mortgage payments, education costs, and daily living expenses. This financial safety net allows families to maintain their standard of living and helps eliminate the financial burden that could arise from losing a primary earner.

Moreover, the guaranteed death benefit offers peace of mind, knowing that loved ones will be taken care of during a challenging time. As young families typically have limited financial resources, the fixed premiums associated with whole life insurance also create a consistent budget plan, allowing families to incorporate these costs into their long-term financial strategies. By choosing whole life insurance, families can focus on nurturing their relationships and future without the looming worry of financial instability.

Cash Value Growth

Another critical advantage of whole life insurance for young families is the cash value component that grows over time. This aspect of the policy acts as a savings vehicle, allowing families to build wealth as they pay their premiums. The cash value growth is tax-deferred, meaning there are no immediate tax implications as the funds accumulate. This type of savings can be especially beneficial when unexpected expenses arise, such as medical emergencies or urgent home repairs.

Additionally, families can access this cash value through loans or withdrawals, providing a crucial financial resource without needing to liquidate other investments at potentially inopportune times. For young families just starting their financial journeys, having access to this form of savings can make a significant difference in handling life’s uncertainties while preserving the integrity of their life insurance protection.

Versatility

Whole life insurance also offers versatility in terms of coverage and payment options. With whole life policies, policyholders can choose to pay premiums for a set number of years or throughout their entire lives. This flexibility allows young families to tailor their policy to fit their specific financial needs. Similarly, they have the option to adjust the death benefit amount as their circumstances change, ensuring that the policy remains relevant and useful throughout different stages of life.

Furthermore, whole life insurance can be used as a retirement planning tool for young families. As cash value accumulates and matures over time, it can supplement income during retirement or act as an inheritance for future generations. This added flexibility makes whole life insurance an attractive choice for young families looking to secure their financial future.

Comparing Whole Life Insurance Quotes

When comparing whole life insurance quotes, it’s essential to consider not only the premium amount but also the coverage and benefits provided by each policy. As mentioned earlier, different types of whole life policies may offer varying features that can affect the overall cost. It’s crucial to carefully review and compare these factors to ensure you’re getting the best value for your specific needs.

What to Look For When Comparing Quotes

When comparing whole life insurance quotes, there are several key factors to consider to make an informed decision. First, evaluate the premium amounts and whether they fit within your family’s budget. It’s important to ensure that the financial commitment is manageable over the long term, especially as circumstances may change.

Next, examine the death benefit offered by each policy. Ensure that the coverage amount is adequate to protect your family’s financial future, taking into account current and future expenses such as housing, education, and daily living costs.

Additionally, consider the cash value growth features. Different policies may have distinctive approaches to accumulating cash value, including growth rates and potential dividends, which can significantly impact long-term savings. Finally, review the insurer’s reputation and financial stability. Research customer reviews and ratings, along with the company’s claims-paying history, to ensure you are choosing a reliable provider with strong customer support. By considering these aspects, you can confidently select a whole life insurance policy that aligns with your family’s needs and financial goals.

Comparing Top Whole Life Insurance Quotes in the US for 2024

When comparing whole life insurance quotes, it’s essential to stay informed about current market trends. As policies and rates may change over time, regularly reviewing top providers and their offerings can help you secure the best deal for your family’s needs. Based on recent research and projections, here are some of the top whole life insurance quotes to consider in the US for 2024:

- New York Life – This insurer has consistently ranked among the top whole life insurance providers with competitive rates and excellent financial strength ratings.

- Northwestern Mutual – With a long history of strong financial stability ratings and comprehensive coverage options, this provider is a popular choice for families looking for whole life insurance.

- MassMutual – This insurer offers a variety of customizable whole life policies and features, including flexible payment options and cash value growth potential.

- Guardian Life – Known for its high-quality customer service and competitive rates, this company offers various attractive options in the whole life insurance market.

By comparing these top providers and their offerings, you can find a reliable and suitable policy that will provide long-term financial security for your family. Remember to regularly review your coverage needs and adjust your policy accordingly to ensure it remains relevant throughout different stages of life. With careful research and consideration, whole life insurance can be an essential tool in securing your family’s financial future.

Case Studies for Better Understanding

To better understand how whole life insurance can benefit young families, let’s explore some case studies of real individuals and their experiences with this type of coverage.

Case Study 1: The Smith Family

The Smith family consists of John and Sarah, both in their early 30s, with two young children. They recently purchased a whole life policy each to protect their family’s financial future. John chose a policy with a low premium payment period of 10 years, while Sarah opted for a more extended payment period of 30 years.

They were drawn to the flexibility of whole life insurance as it allowed them to tailor their coverage and payment options to fit their current and future needs. With the added benefit of cash value accumulation, they feel confident that their policy will not only provide protection but also act as an investment for their retirement.

Case Study 2: The Rodriguez Family

Maria and Jose Rodriguez, both in their 40s, have three grown children who are now financially independent. They decided to purchase a whole life insurance policy that would not only provide coverage for their remaining years but also serve as an inheritance for their grandchildren. The cash value growth potential of the policy was a significant factor in their decision, along with the ability to adjust the death benefit amount as needed. This gives them peace of mind knowing they have a secure financial future for themselves and their family.

The Application Process and What to Expect of Whole Life Insurance

When applying for whole life insurance, you can expect a thorough evaluation of your health and lifestyle factors. This process may include completing medical exams, providing personal information, and answering questions about your current and past health conditions. The insurer will also consider your age, occupation, hobbies, and other factors when determining your premium amount.

Research and Compare Providers

After you’ve gathered initial quotes and considered the essential factors, the next step is to conduct thorough research on various insurance providers. Look beyond the quotes themselves and investigate each company’s history, customer service quality, and claims process. Online reviews and customer testimonials can provide insight into the experiences of others, which may guide your decision-making process. Additionally, don’t hesitate to contact the insurers directly with your questions; knowledgeable representatives can clarify policies and features, ultimately helping you find a plan that aligns with your expectations and requirements.

Understanding Policy Riders

As you compare whole life insurance quotes, consider the potential benefits of policy riders—additional features that can enhance your coverage. Common riders include accelerated death benefit riders, which allow you to access a portion of the death benefit in case of terminal illness, and waiver of premium riders, which ensure your premiums are paid if you become disabled. Investigating these options can make your policy even more valuable and tailored to your specific life circumstances. Taking a comprehensive approach to research ensures you not only find a competitively priced policy but also one that meets your family’s unique needs.

Tips for a Smooth Application

Navigating the application process for whole life insurance can feel overwhelming, but with a few strategic steps, you can ensure a smoother experience. First, gather all necessary documentation, such as identification, tax returns, and medical records, as insurance providers may request these during the evaluation. Next, be honest and thorough when answering health-related questions; discrepancies can lead to complications or rejections of coverage later on. It’s also advisable to consult with an insurance agent, as they can help clarify the nuances of different policies, suggest appropriate riders, and guide you through any potential pitfalls. Finally, don’t rush the decision-making process. Take the time to reflect on what best suits your family’s financial situation and long-term goals, as a well-informed choice today can lead to peace of mind for years to come.

Conclusion

In summary, whole life insurance serves as a valuable financial tool for families seeking security and peace of mind. By understanding the various features, benefits, and factors to consider when selecting a policy, you can make informed choices that fit your family’s unique needs. The case studies of families who have benefitted from whole life insurance demonstrate how it can provide both protection and investment opportunities, adapting to life changes as they arise. As you navigate the application process and compare providers, remember to leverage resources such as insurance agents and customer reviews to facilitate your decision-making. With careful planning and consideration, whole life insurance can be a key component in building a secure financial future for you and your loved ones.