The life insurance industry is witnessing a significant shift towards digital platforms, driven by the increasing demand for convenience and efficiency among younger generations. Ethos Life Insurance stands out as a digital-first provider, offering streamlined online experiences for young adults seeking life insurance. Ethos provides term and limited whole life policies through a fully digital application process, promising both convenience and speed. However, families with young children must carefully weigh the potential benefits against the limitations of Ethos’ coverage options and pricing before making a decision. This Ethos life insurance review aims to provide a comprehensive analysis of Ethos Life Insurance, highlighting both its advantages and disadvantages.

Toc

Ethos Life Insurance Review: Pros and Cons for Young Adults

Ethos Life Insurance: The Basics

Ethos Life Insurance positions itself as a digital-first life insurance provider, aiming to simplify the often complex world of insurance. Founded in 2016, the company partners with established insurers to deliver term life and limited whole life policies. This innovative approach not only enhances accessibility but also aligns with modern consumers’ preference for online services.

Ethos aims to simplify the often-complex world of life insurance, making it more accessible and straightforward for everyone. The company focuses on affordability and user convenience, making it an appealing choice for young adults looking to secure financial protection without the traditional hassles associated with life insurance.

Pros of Ethos Life Insurance for Young Adults

Convenient Online Application

One of the standout features of Ethos Life Insurance is its streamlined online application process. Young adults can receive a preliminary quote in just minutes, allowing them to bypass the often tedious scheduling of in-person meetings or medical exams. This efficiency is particularly beneficial for busy young professionals managing work, education, and personal responsibilities.

Ethos’ online application process is designed to be user-friendly. For example, they offer a digital health questionnaire that can be completed in minutes. This allows applicants to avoid the hassle of traditional medical exams, which can often be time-consuming and inconvenient. The company also provides clear and concise information about its policies, making it easier for young adults to understand their coverage options. In most instances, Ethos does not require a medical exam, further enhancing the convenience of obtaining coverage. With the ability to receive a coverage decision within the same day, Ethos meets the fast-paced lifestyle of young adults who need quick solutions. This aspect of the application process can significantly reduce the stress often associated with securing life insurance.

Affordable Coverage Options

Ethos Life Insurance claims to offer competitive rates, especially for term life policies. Starting premiums can be as low as $7 per month, making it an attractive option for young adults who may be budget-conscious yet wish to ensure their loved ones are financially protected.

Ethos’ term life insurance policies are typically more affordable than traditional whole life policies. This is because term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage and cash value accumulation. The trade-off is that whole life insurance premiums are generally higher. For young adults on a tight budget, term life insurance can be a more cost-effective way to secure financial protection for their loved ones. This affordability can significantly impact young adults’ financial planning, allowing them to secure essential coverage without straining their budgets. The focus on cost-effective solutions aligns perfectly with the financial realities many young individuals face today. For instance, a young professional just starting their career may prioritize saving for student loans or housing, making a low-cost life insurance policy an ideal choice for peace of mind.

Flexible Term Life Coverage

Ethos provides a range of coverage amounts and term lengths, making it easier for young adults to customize their policies according to their specific needs. Coverage amounts range from $20,000 to $2 million, and term lengths vary from 10 to 30 years. This flexibility allows young adults to tailor their insurance plans to their life circumstances, such as ensuring financial security for dependents or covering significant debts.

Ethos offers term lengths ranging from 10 to 30 years. This flexibility allows young adults to choose a term length that aligns with their current life stage and future plans. For instance, a young adult who recently started a family might opt for a 30-year term to ensure coverage until their children reach adulthood. Alternatively, a single young adult may choose a shorter term, such as 10 years, if they anticipate their financial needs changing in the near future. This adaptability is crucial for young adults as they navigate various life stages, from starting families to advancing in their careers.

Child Term Rider

For young parents, Ethos offers a child term rider that allows them to add their children to their life insurance policy. This feature provides an additional layer of financial protection, ensuring that children are covered in the event of an unforeseen tragedy. Such a rider can be invaluable for young families looking to safeguard their children’s future.

This rider can provide coverage for children up to a certain age, typically 18 or 25, depending on the policy specifics. This means that parents can secure a financial safety net for their children, which can be especially comforting for those who may worry about their family’s future in the event of an untimely passing.

Instant Approvals

Ethos offers instant approvals on applications, providing peace of mind and quick access to coverage. Many applicants can expect to have their coverage decisions made on the same day they submit their application. This rapid response time offers peace of mind, allowing young adults to secure their financial future without lengthy delays.

In a world where immediate gratification is often expected, Ethos meets this demand by providing quick feedback on applications. This aspect can be particularly appealing to those who may be anxious about the life insurance process or who need coverage quickly due to life changes, such as marriage or the birth of a child.

Cons of Ethos Life Insurance for Young Adults

Limited Whole Life Options

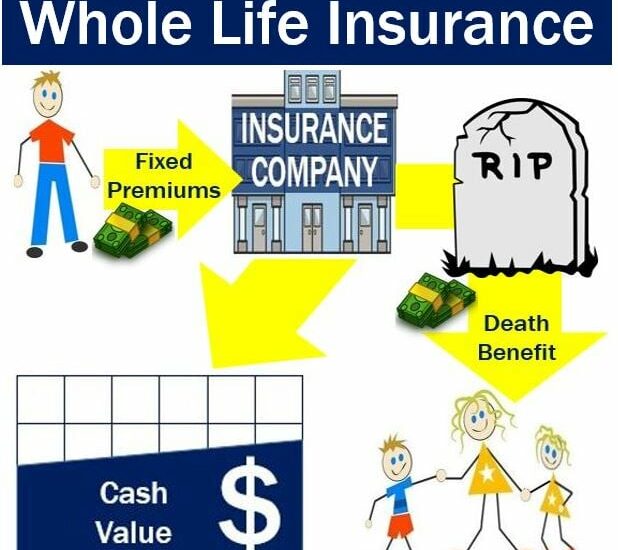

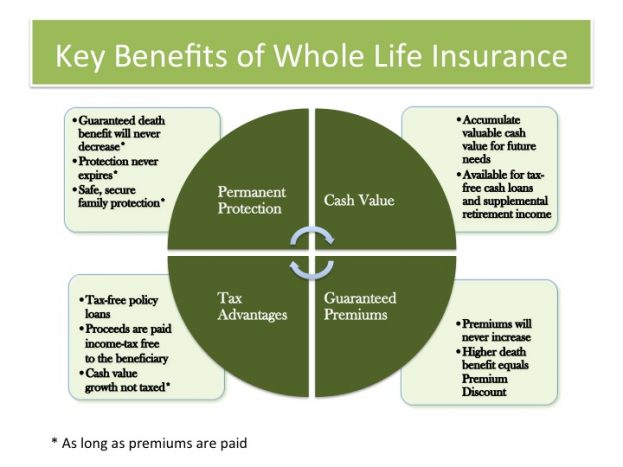

While Ethos excels in term life insurance offerings, it has limited whole life options primarily designed for seniors seeking final expense coverage. Young adults typically prefer permanent life insurance for its lifelong coverage and cash value accumulation. The lack of robust whole life policies could be a drawback for those seeking long-term financial solutions.

Whole life insurance can serve as a vital financial tool, allowing policyholders to build cash value over time, which can be borrowed against or withdrawn in the future. Young adults looking for investment opportunities may find the absence of these options at Ethos limiting.

Higher Premiums for Some

Another consideration is that premiums may be higher than those offered by traditional life insurance companies, particularly for applicants with pre-existing conditions. The convenience and speed of the application process can come at a cost, potentially making Ethos less appealing for some individuals.

While Ethos claims to offer competitive rates, it’s crucial to compare quotes from multiple providers before making a decision. Some traditional life insurance companies may offer lower premiums for certain individuals, particularly those with excellent health or who are seeking higher coverage amounts. For young adults with health concerns, this could result in higher monthly payments, which may not align with their financial goals. For example, a young adult diagnosed with a chronic condition may find that their premiums are significantly higher than they would be with a more traditional insurer that requires a medical exam.

Limited Rider Selection

Ethos offers a limited selection of policy riders compared to traditional life insurance providers. While options like the child term rider and accidental death rider are available, the overall selection may not meet the customization needs of all young adults. Traditional insurers often provide a broader array of riders, allowing for more tailored coverage.

Young adults may want additional riders, such as those for critical illness or disability income protection, which Ethos may not offer. This limitation could hinder their ability to create a comprehensive insurance policy that meets all their needs.

Alternatives to Ethos Life Insurance

While Ethos may be a suitable option for some young adults, it’s crucial to explore alternatives that may offer more comprehensive coverage options. Some noteworthy alternatives include:

Bestow Life Insurance

Bestow Life Insurance is an appealing option for young adults seeking a streamlined application process and affordable term life insurance coverage. Similar to Ethos, Bestow offers a fully digital application, allowing applicants to get coverage without the need for a medical exam. This can be particularly attractive for millennials and Gen Z individuals who are accustomed to handling financial matters online. Bestow provides a range of term lengths, from 10 to 30 years, accommodating various life stages and financial plans. However, unlike traditional insurers that offer whole life or diverse riders, Bestow focuses solely on term life policies, which may not meet the needs of those looking for permanent life insurance or customizable coverage options. Therefore, potential policyholders should assess their long-term financial goals and insurance needs when considering Bestow as an alternative.

Haven Life Insurance

Haven Life Insurance is another compelling alternative for young adults seeking a balance of affordability and comprehensive coverage options. Known for its customer-friendly digital experience, Haven Life offers a seamless online application process. The company provides term life insurance policies without mandatory medical exams for many applicants, appealing to individuals who value convenience and speed. Haven Life stands out by offering additional riders, such as the “Haven Plus” rider, which includes benefits like access to online will services and fitness discounts, enhancing the overall value of the policy. Moreover, Haven Life is backed by MassMutual, a well-established insurer, lending a sense of security and stability. Young adults should consider Haven Life if they are interested in a straightforward insurance solution with added perks. However, as with other term-focused providers, those seeking permanent life insurance will need to look elsewhere.

Fabric Life Insurance

Fabric Life Insurance is another notable option for young adults who are looking for flexibility and family-oriented policies. Fabric provides both term life and accidental death insurance, allowing policyholders to choose coverage that suits their specific needs. One of Fabric’s standout features is its user-friendly app, which offers a host of tools for financial planning, including the ability to create a will and organize financial documents. This comprehensive approach can help young families manage their financial futures beyond just life insurance. Additionally, Fabric allows policyholders to increase their coverage as their needs change without requiring a new application, making it a versatile choice for those with evolving financial responsibilities. While Fabric’s focus on digital convenience is beneficial for many, it may not satisfy individuals who prefer in-person consultations or those seeking permanent life insurance products. Young adults can consider Fabric if they want a simplistic, app-focused solution for managing both insurance and basic financial planning.

Conclusion

In summary, the Ethos life insurance review highlights both the benefits and drawbacks of choosing Ethos for young adults seeking life insurance. The convenient online application process, affordable coverage options, and flexible term life insurance make it a compelling choice for many. However, potential customers should carefully consider the limited whole life options, the possibility of higher premiums for certain individuals, and the restricted rider selection.

As financial literacy among young adults continues to grow, they are increasingly proactive in seeking out affordable and accessible life insurance options that meet their specific needs. When evaluating life insurance options, young adults should compare quotes from Ethos and other providers to find the best coverage and pricing that align with their unique needs and financial goals. By doing thorough research and considering all available options, young adults can make informed decisions that secure their financial future and protect their loved ones. Ethos Life Insurance may be a suitable option, but exploring all alternatives is crucial to ensure the best fit for individual circumstances.