MetLife Metropolitan is a leading insurance provider that helps individuals and families secure their financial future through customized insurance plans. With over 150 years of experience, MetLife Metropolitan has been providing reliable and comprehensive insurance coverage to millions of people globally.

Toc

- 1. Introduction to Metlife Insurance

- 2. Types of Insurance Offered by MetLife Metropolitan

- 3. Unique Features and Benefits

- 4. Bài viết liên quan:

- 5. Comparative Analysis of Metlife metropolitan life insurance company

- 6. Case Studies and Examples of Customer Satisfaction

- 7. Comparative Analysis: MetLife vs. Other Insurers

- 8. Conclusion

Introduction to Metlife Insurance

Navigating the insurance landscape can be daunting. With countless options available, it’s essential to choose a provider with a robust reputation and financial stability. MetLife Metropolitan Life Insurance Company, often referred to simply as MetLife, stands out as a beacon of trust and reliability in the industry. Founded in 1868, MetLife has spent over a century building a legacy of excellence, serving millions of customers worldwide. Its commitment to financial stability and customer satisfaction makes it a top choice for those seeking comprehensive insurance solutions.

Why Choose MetLife Metropolitan?

At MetLife Metropolitan, we understand that everyone’s needs are unique when it comes to insurance. That’s why we offer a wide range of insurance options to cater to the diverse needs of our customers. Whether you are looking for life, health, disability, or retirement insurance, we have got you covered.

Our team of experienced professionals works closely with each client to understand their specific requirements and create tailored solutions that provide the best coverage and value. We believe in transparency, and we’ll make sure you understand the details of your policy so you can make informed decisions.

Our Commitment to Financial Stability

When choosing an insurance provider, it’s crucial to consider their financial stability. MetLife Metropolitan has consistently received top ratings from leading credit rating agencies, indicating our strong financial standing. We are committed to ensuring that we have the resources to honor our obligations and provide peace of mind to our customers.

Customer Satisfaction at the Core

At MetLife Metropolitan, customer satisfaction is at the core of everything we do. We strive to build long-lasting relationships with our clients based on trust, transparency, and exceptional service. Our dedicated customer support team is always available to assist our customers with any questions or concerns.

Types of Insurance Offered by MetLife Metropolitan

MetLife Metropolitan offers a wide range of insurance options to meet the diverse needs of individuals and families. These include:

Life Insurance

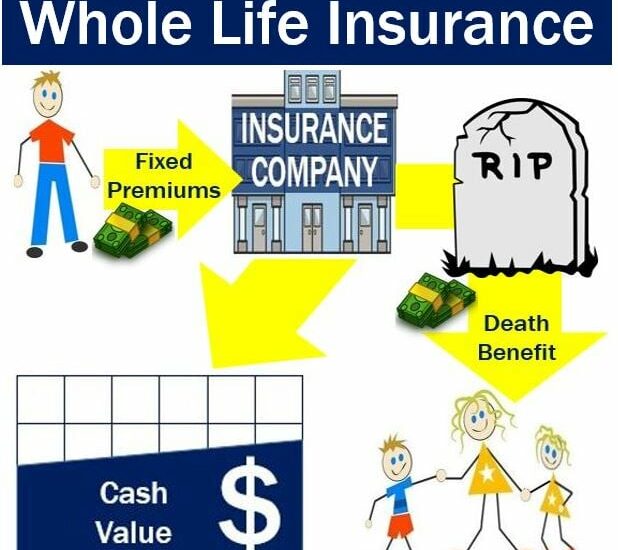

Life insurance is a vital financial tool that provides security and peace of mind for your loved ones in the event of your passing. At MetLife Metropolitan, we offer various life insurance products tailored to meet your unique circumstances. Our options include term life insurance, which provides coverage for a specified period, and whole life insurance, offering lifelong protection along with a cash value component. By choosing the right life insurance policy, you ensure that your family’s financial future remains secure, covering expenses such as mortgage payments, educational costs, and daily living expenses.

Health Insurance

In addition to life insurance, MetLife Metropolitan provides comprehensive health insurance plans that cater to the varying needs of individuals and families. Our health insurance options include medical, dental, and vision coverage, ensuring that you and your loved ones have access to essential healthcare services. We understand that healthcare can be a significant financial burden, which is why our plans are designed to offer flexibility and value, putting your health and well-being first.

Disability Insurance

Disability insurance is crucial in protecting your income should an unforeseen event leave you unable to work. MetLife Metropolitan offers short-term and long-term disability insurance plans that help replace a portion of your income, allowing you to focus on recovery without the added stress of financial instability. Our policies are designed to provide the support you need during difficult times, ensuring that you can maintain your lifestyle and meet your financial obligations.

Retirement Insurance

Planning for retirement is essential for a secure financial future. MetLife Metropolitan offers various retirement insurance products, including annuities and retirement savings plans, which can help you build a comfortable nest egg for your golden years. Our retirement solutions are tailored to your specific goals, ensuring you have the resources needed to enjoy financial independence and peace of mind during retirement.

Unique Features and Benefits

MetLife’s insurance policies come with several unique features and benefits that set them apart from other providers.

Customizable Coverage Options

At MetLife Metropolitan, we recognise that a one-size-fits-all approach does not work when it comes to insurance. Therefore, we offer customizable coverage options tailored to fit individual needs and preferences. Whether you’re looking to enhance your life insurance policy with additional riders, adjust your health insurance plan to include specific treatments, or create a retirement savings strategy that adapts to your changing circumstances, we provide the flexibility to build a plan that reflects your unique situation. Our expert advisors are dedicated to guiding you through the customization process, ensuring you receive the best protection while maximising value.

Competitive Premiums

Understanding the importance of affordability, MetLife Metropolitan offers competitive premiums across all our insurance products. We strive to deliver comprehensive coverage without compromising on quality or breaking the bank. By leveraging our extensive experience and financial strength, we are able to pass on cost savings to our clients, allowing you to secure the coverage you need at a price that fits your budget.

Exceptional Claims Support

In times of need, the prompt and efficient handling of claims is crucial. MetLife Metropolitan prides itself on providing exceptional claims support, ensuring that customers can confidently navigate the claims process. Our dedicated claims team is trained to guide you through each step, alleviating any stress during difficult times. With our streamlined claims process, you can expect quick resolutions and the financial support you require when it matters most.

Bài viết liên quan:

- https://ningems.com/how-to-get-cheaper-car-insurance-a-comprehensive-guide-for-first-time-buyers/

- https://ningems.com/the-best-insurance-comparison-sites-for-new-drivers-unlock-savings-and-find-the-right-coverage/

- https://ningems.com/building-financial-security-whole-life-insurance-and-quotes-explained/

- https://ningems.com/ethos-life-insurance-review-is-it-right-for-young-adults/

- https://ningems.com/cars-with-best-insurance-a-comprehensive-guide-for-new-car-buyers/

By choosing MetLife Metropolitan, you are not just getting an insurance provider; you are gaining a partner committed to your financial security and overall well-being.

Comparative Analysis of Metlife metropolitan life insurance company

MetLife Metropolitan stands out amongst its competitors in the insurance industry due to its commitment to customer satisfaction, customizable coverage options, and competitive premiums. Our strong financial standing and exceptional claims support also set us apart from other providers. Additionally, our wide range of insurance products allows us to cater to the diverse needs of individuals and families, making us a one-stop-shop for all your insurance needs.

Market Position

MetLife Metropolitan has firmly established itself as a leading player in the insurance market, attributed to its robust financial performance and extensive service offerings. With a customer-centric approach, the company consistently ranks among the top insurers in terms of policyholder satisfaction and retention rates. By leveraging innovative technology and data analytics, MetLife Metropolitan enhances its decision-making processes, optimises premium pricing strategies, and tailors products that resonate with customer demands. This alignment with market trends and consumer preferences positions the company as a trusted and reliable choice for individuals and families seeking comprehensive insurance solutions. Moreover, ongoing investments in marketing and outreach help MetLife Metropolitan maintain a strong brand presence, further solidifying its competitive advantage in the industry.

Differentiating Factors

MetLife Metropolitan differentiates itself from other insurance companies through its focus on customization, affordability, and exceptional customer service. We understand that every individual has unique needs and priorities, and we aim to provide tailored solutions that meet those specific requirements. With our competitive premiums and comprehensive coverage options, we make quality insurance accessible to a wider audience. Our commitment to prompt claims support also sets us apart, providing peace of mind during challenging situations. Additionally, our strong brand reputation and market position give customers confidence in choosing MetLife Metropolitan as their preferred insurance provider.

Case Studies and Examples of Customer Satisfaction

To illustrate the effectiveness of MetLife Metropolitan’s insurance solutions and customer service, we can highlight several case studies that exemplify our commitment to client satisfaction and support during crucial moments.

Case Study 1: Health Insurance Support During Recovery

A customer, Jane, faced a challenging time after a major surgery that required extensive rehabilitation. With MetLife’s health insurance policy, Jane received timely coverage for her medical expenses and rehabilitation therapy. Our dedicated claims team assisted her throughout the process, ensuring that her claims were processed swiftly, allowing her to focus on her recovery without the burden of financial stress. Jane expressed her gratitude for the peace of mind and support she received, further enhancing her trust in our services.

Case Study 2: Tailored Retirement Planning

Another client, Mark, approached MetLife Metropolitan to explore retirement options. Through our personalized retirement insurance consultations, we helped him design a comprehensive retirement savings plan that aligned with his long-term goals. By incorporating annuities and other savings vehicles, Mark was able to build a secure financial future. Years later, he reported feeling prepared and confident entering retirement, highlighting the value of our flexible and tailored approach.

Case Study 3: Bereavement Support

A client, Sarah, unfortunately lost her spouse in a tragic accident. As she navigated through this difficult time, MetLife Metropolitan’s exceptional claims support team provided assistance and guidance throughout the claims process. Our prompt and efficient handling of the claim enabled Sarah to receive the financial support required to cover funeral expenses and other unforeseen costs associated with her loss.

Comparative Analysis: MetLife vs. Other Insurers

When evaluating MetLife Metropolitan in comparison to other major insurance providers, several key differentiators emerge. Firstly, our depth of experience in the industry translates to a nuanced understanding of customer needs and market dynamics. This expertise allows us to offer not only competitive premiums but also bespoke coverage options that are often lacking with other insurers.

MetLife vs. Competitors: Financial Stability

MetLife Metropolitan maintains a strong financial standing, with consistently high credit ratings from industry-standard agencies. This stability allows us to honour our commitments and provide dependable support to our policyholders when they need it most. In contrast, some other insurers may struggle during economic downturns or unexpected events, potentially leaving their customers vulnerable.

MetLife vs. Competitors: Product Range

The wide range of insurance products offered by MetLife Metropolitan also gives us an edge over competitors who may have a more limited selection or specialize in particular types of insurance. Our comprehensive offerings allow individuals and families to consolidate their insurance needs with one provider, simplifying the process and potentially saving on costs. Additionally, our customized solutions cater to diverse lifestyles and budgets, making it easier for clients to find coverage that meets their unique circumstances.

MetLife vs. Competitors: Customer Service

Finally, customer service is a key aspect that sets us apart from other insurers. Our emphasis on prompt and personalized assistance has resulted in high levels of customer satisfaction and retention rates. We prioritize building long-term relationships with our clients and strive to provide exceptional service at every touchpoint. This dedication to customer support is often lacking in the insurance industry, giving MetLife Metropolitan a significant competitive advantage.

Conclusion

The conclusion of your insurance experience with MetLife Metropolitan encapsulates our unwavering commitment to your financial security and peace of mind. By choosing MetLife, you not only gain access to a comprehensive suite of insurance solutions tailored to your unique needs but also a supportive partnership that prioritises your well-being. Our adaptable offerings and personalised customer service exemplify our dedication to fostering long-lasting relationships with our clients. As you navigate the complexities of insurance planning, trust that MetLife Metropolitan will stand by you, providing the resources, guidance, and support necessary for a secure financial future. We look forward to helping you achieve your goals and protecting what matters most to you.