Navigating the car insurance landscape can be overwhelming, especially for new drivers facing a barrage of confusing terms and complex policies. While contacting each insurer individually may seem like the only option, a powerful tool exists to simplify this process: the best insurance comparison sites. These platforms allow you to compare quotes from multiple insurers in one place, potentially saving hundreds of dollars on your annual premiums. By leveraging these comparison tools, new drivers can make informed decisions about their insurance needs and secure the best coverage at competitive rates.

Toc

The Advantages of Using the Best Insurance Comparison Sites

The insurance industry has witnessed a surge in the popularity of online comparison platforms, transforming how drivers shop for coverage. These platforms offer a user-friendly experience, allowing drivers to compare quotes from multiple insurers in a clear and transparent manner. However, the sheer number of sites available can be overwhelming, making it crucial to identify the best insurance comparison sites that offer the most comprehensive and accurate information.

Convenience

One of the primary benefits of using the best insurance comparison sites is the convenience they offer. These sites eliminate the need to visit multiple insurance company websites or make numerous phone calls to gather quotes. Instead, users can enter their information once, and receive a range of quotes tailored to their specific needs. This centralized approach not only saves time but also reduces the stress often associated with the insurance shopping process. Furthermore, many comparison sites provide additional resources, such as policy reviews and educational content, to help users better understand their options and make informed decisions.

Cost Savings

Another significant advantage of utilizing the best insurance comparison sites is the potential for cost savings. By comparing quotes from various insurers, drivers can identify the most competitive rates available for their coverage needs. These platforms often highlight discounts or special offers that might not be immediately apparent when dealing with individual insurers. This transparency ensures that drivers are well-aware of potential savings, allowing them to optimize their insurance budget effectively. Additionally, many comparison sites provide tools that help users experiment with different coverage levels and deductible amounts, enabling further personalization and cost efficiency in their insurance plans. Such features empower drivers to achieve the best value for their money without compromising on necessary coverage.

Transparency and Comprehensive Information

A key advantage of the best insurance comparison sites is the transparency they bring to the often-complex insurance landscape. These platforms provide clear and comprehensive details about policies, including coverage limits, exclusions, and terms and conditions. This level of transparency allows drivers to gain a complete understanding of what each policy entails, reducing the likelihood of unexpected surprises or hidden fees in the future. Furthermore, users can access reviews and ratings from other customers, offering real-world insights into the experiences of policyholders with different insurers. This information can be invaluable, guiding drivers toward providers known for their reliability and customer satisfaction.

Customization and Flexibility

Insurance needs vary significantly from driver to driver, which is why the ability to customize and adjust coverage options through comparison sites is crucial. The best platforms offer flexible tools that allow users to manipulate policy variables such as coverage types, limits, and deductibles. This flexibility ensures that drivers can tailor their insurance policies to closely align with personal needs and budgets. As a result, they can construct a policy that offers both comprehensive protection and affordability, maintaining peace of mind on the road.

How the Best Insurance Comparison Sites Work

The mechanics of using the best insurance comparison sites are straightforward. You’ll be asked to provide basic information about yourself, your driving history, and the vehicle you’re insuring. This typically includes your age, zip code, driving record, and vehicle details (make, model, year).

Information Gathering

When you visit a comparison site, the first step involves gathering essential information. You’ll need to input details such as:

- Personal Information: This includes your name, age, and contact details. Insurers often consider age as a significant factor in determining your risk level.

- Driving History: You’ll be asked about your driving record, including any accidents, traffic violations, or claims you’ve made in the past. A clean driving history can lead to lower rates.

- Vehicle Details: Provide information about the car you intend to insure, including its make, model, year, and any safety features it may have. The type of vehicle you drive can significantly impact your insurance premiums.

Quote Generation

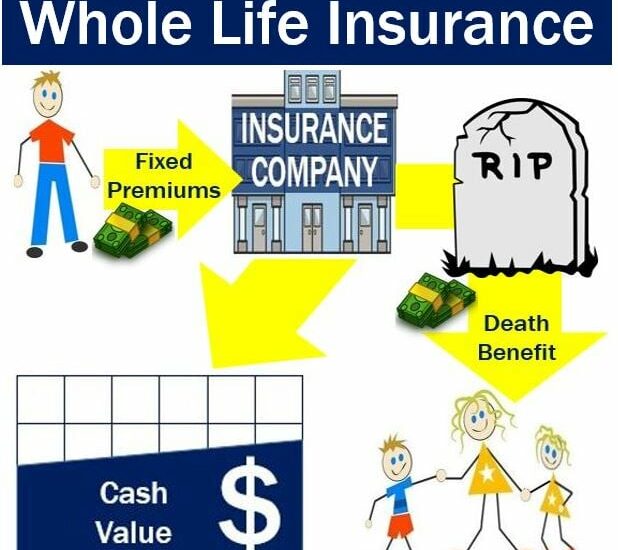

Once all essential information has been inputted, the insurance comparison site uses advanced algorithms to scour its extensive network of insurance providers. Within minutes, users are presented with a list of potential insurance plans, each tailored to the specific details entered. These plans are typically ranked based on cost, coverage options, and customer feedback, offering a holistic view of what’s available. This process allows drivers to quickly identify and compare the most suitable policies without the hassle of contacting each insurer individually. Moreover, these platforms often provide filters and sorting tools, enabling users to refine their search based on criteria such as lower monthly premiums, comprehensive coverage options, or user ratings. Ultimately, the efficiency and precision of the comparison process empower drivers to make informed decisions swiftly, securing optimal coverage in a fraction of the time it would take through traditional methods.

Policy Selection and Purchase

After evaluating the generated quotes, the next step involves selecting the best insurance policy for your needs. Insurance comparison sites typically simplify this process by allowing you to compare various components of each policy side by side. Review aspects such as the premium costs, coverage limits, deductibles, and any additional features that may be important to you or your vehicle.

Once you have chosen the policy that suits you best, the sites often provide seamless links to either purchase the policy directly through their platform or redirect you to the insurer’s website for completion. This integration not only saves time but also ensures a secure and streamlined purchasing experience. During this step, it’s crucial to verify the final details of the policy to confirm that all the terms align with what was initially presented.

Furthermore, many comparison websites offer ongoing customer support, should any questions arise during policy selection or purchase. This assistance can be particularly beneficial for first-time insurance buyers or those who have specific queries about coverage specifics. Engaging with these platforms provides a robust framework for obtaining insurance, merging convenience with comprehensive insights for an overall superior shopping experience.

Finalizing and Managing Your Policy

Once your insurance policy is active, it’s essential to manage it effectively to ensure continued coverage and to maximize potential savings. Most top-tier insurance comparison sites offer tools that help policyholders keep track of their coverage details, payment schedules, and renewal dates. Some platforms even provide alerts or reminders for upcoming payments or policy renewals, ensuring that drivers never miss a critical deadline.

It’s also prudent to periodically reassess your insurance needs, as life changes such as a new car purchase, relocation, or even changes in your driving habits can impact your coverage requirements. Insurance comparison sites can facilitate this by allowing users to easily modify their existing policies or explore new options as needed. This dynamic adaptability helps maintain a policy that best fits your current situation without unnecessary or redundant coverage, ensuring you always have the right protection in place.

In addition, staying informed about potential discounts or changes in the insurance market can also lead to significant cost savings over time. Many sites offer newsletters or updates regarding new offers, discounts, or innovative coverage options, keeping you in the loop about opportunities to enhance your policy or reduce costs.

Factors Affecting Your Car Insurance Rates as a New Driver

As a new driver, you may face higher insurance premiums than more experienced motorists. This is due to a variety of factors that insurers consider when determining your rates:

Age

Younger drivers, especially those under 25, are often considered higher risk and may face higher premiums. Statistically, drivers in this age group are more likely to be involved in accidents. As you gain driving experience, your rates tend to decrease.

Driving Record

A clean driving record is crucial for securing lower insurance rates. Accidents, speeding tickets, or other traffic violations can significantly impact your premiums. Insurers view a history of safe driving as an indicator of responsible behavior, which can translate into lower rates.

Vehicle Type

The make, model, and age of your car can influence your insurance costs. Vehicles with higher repair costs or a history of theft may have higher premiums. Additionally, certain vehicles are more prone to accidents, which can also affect your rates.

Location

Your location can play a significant role in your insurance rates. Drivers in urban areas with higher accident rates generally pay more than those in rural regions. Factors such as population density, crime rates, and local traffic patterns all contribute to how insurers assess risk in different areas.

Credit Score

In many states, your credit history is a factor in determining your car insurance rates. Drivers with lower credit scores may face higher premiums. Insurers argue that individuals with poor credit are more likely to file claims, making this a critical consideration in the underwriting process.

Top Insurance Comparison Sites for New Drivers

When it comes to finding the best insurance comparison sites for new drivers, several platforms stand out:

Insurify

Insurify offers a user-friendly platform that provides real-time quotes from a wide range of insurers. With its robust partnerships, Insurify can help you find the most competitive rates and coverage options tailored to your needs. However, it’s important to note that Insurify may not offer quotes from all insurance providers in every state, so it’s wise to check your specific area.

NerdWallet

NerdWallet is a comprehensive personal finance platform that includes a robust car insurance comparison tool. While it may not offer real-time quotes, NerdWallet provides detailed reviews and recommendations to help you make an informed decision. The site’s personalized approach can be especially helpful for new drivers navigating the insurance landscape. Additionally, NerdWallet offers financial advice that can help you manage your overall insurance costs.

The Zebra

The Zebra is a leading insurance comparison site that offers a wide range of options from multiple providers. Although it may not deliver real-time quotes, The Zebra’s detailed coverage comparisons and helpful resources can be invaluable for new drivers. The platform’s extensive database can be overwhelming for some, but its depth of information can also be a significant advantage. The Zebra also features a unique “insurance IQ” quiz that can help you understand your coverage needs better.

Compare-com

Compared to other comparison sites, Compare.com stands out for its easy-to-use interface and detailed, no-frills quotes. Unlike some platforms that act as lead generators, Compare.com does not share your information with third parties, providing a more streamlined and private experience. However, the site may not offer quotes from all insurers in every state, so be sure to check its coverage for your area.

Jerry

Jerry is a unique all-in-one app that simplifies the process of comparing car insurance, as well as other services like loans and vehicle repairs. While it doesn’t provide real-time quotes, Jerry’s convenient platform and rewards system for driving can be attractive for new drivers. Just keep in mind that the app may not offer policies from all insurance providers, so it’s advisable to cross-reference with other comparison sites.

Tips for Getting the Best Car Insurance Rates as a New Driver

While using the best insurance comparison sites is a crucial first step, there are additional strategies you can employ to secure the most favorable car insurance rates as a new driver:

- Shop Around: Don’t settle for the first quote you receive. Use multiple comparison sites to explore a variety of options and find the most competitive rates. The best comparison site for car insurance may vary based on your specific needs.

- Consider Discounts: Ask about potential discounts, such as good student, safe driver, or multi-policy discounts, which can significantly reduce your premiums. Many insurers offer discounts for bundling policies, such as combining car insurance with renters or homeowners insurance.

- Maintain a Clean Driving Record: Avoid traffic violations and accidents, as a spotless driving history can help you qualify for lower insurance rates. Consider taking a defensive driving course, which may also lead to additional discounts.

- Choose the Right Coverage: Evaluate your coverage needs carefully, ensuring you have enough protection without overpaying for unnecessary extras. For instance, if you drive an older vehicle, you may not need comprehensive coverage, which could save you money.

- Consider Your Driving Habits: If you drive relatively low mileage, inquire about low-mileage discounts that could further lower your insurance costs. Some insurers offer pay-per-mile insurance, which can be beneficial for infrequent drivers.

- Be Prepared: Have all the necessary information about your vehicle, driving history, and location readily available when seeking quotes. This preparation can expedite the process and ensure you receive accurate quotes.

- Negotiate: Don’t hesitate to negotiate with insurers to potentially lower their rates. If you receive a lower quote from another provider, you can use that information to negotiate better terms with your current insurer.

- Review Annually: Your insurance needs may change over time. Make it a habit to review your policy annually to ensure you still have the best coverage at the best rates. Life changes, such as moving to a new location or purchasing a new vehicle, can impact your insurance needs.

Conclusion

The best insurance comparison sites have emerged as powerful tools, streamlining the process of finding the right car insurance coverage at affordable rates for new drivers. By understanding the factors that influence your insurance costs, utilizing top comparison sites, and employing strategic tips, you can secure the best possible insurance as a new driver.

Start your search today and take advantage of the convenience and cost-saving benefits of these comparison tools. Unlock the savings and find the coverage that fits your needs and budget. With the right approach and resources, you can navigate the complexities of car insurance with confidence, ensuring that you are well-protected on the road ahead.